PENGARUH KOMPENSASI EKSEKUTIF, KEPEMILIKAN INSTITUSIONAL, DAN PREFERENSI RISIKO EKSEKUTIF TERHADAP PENGHINDARAN PAJAK

DOI:

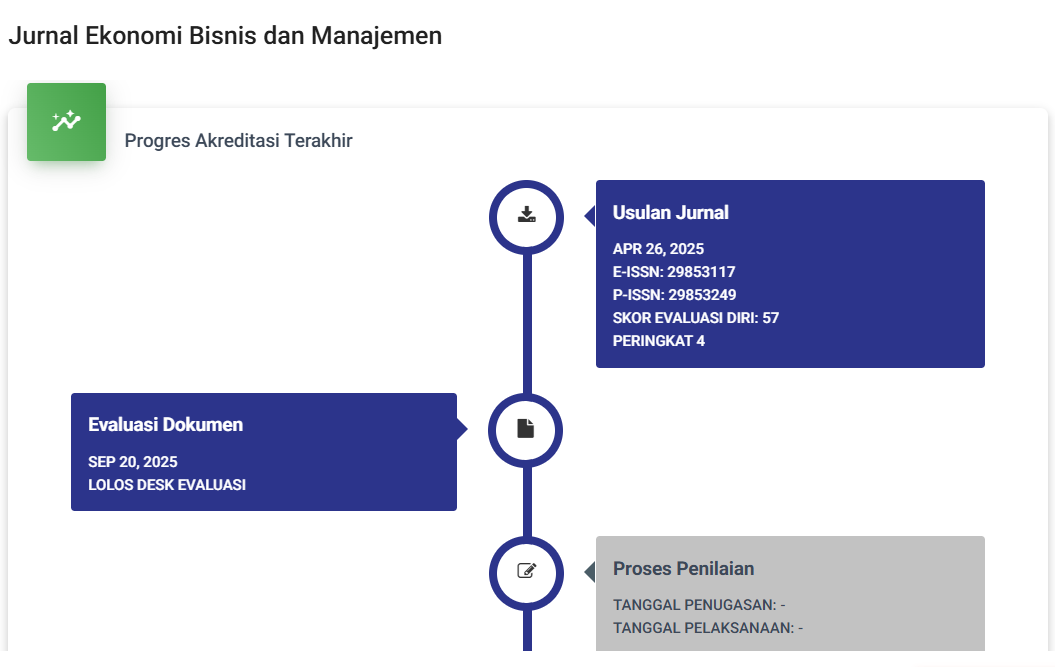

https://doi.org/10.59024/jise.v1i1.27Keywords:

: sales revenue, break even point, Angel LaundryAbstract

The purpose of this study is to determine whether executive compensation, institutional ownership and executive risk preference affect tax avoidance. An empirical study on LQ 45 companies listed on the Indonesia Stock Exchange from 2016 to 2020. The sample in this study consisted of 11 LQ 45 companies with a total of 55 data processed with Eviews-9 software. The analysis technique in this research is quantitative using panel data regression method. The results of this study indicate that executive compensation has an effect on tax avoidance, while institutional ownership and executive risk preference have no effect on tax avoidance.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 JURNAL EKONOMI BISNIS DAN MANAJEMEN (JISE)

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.