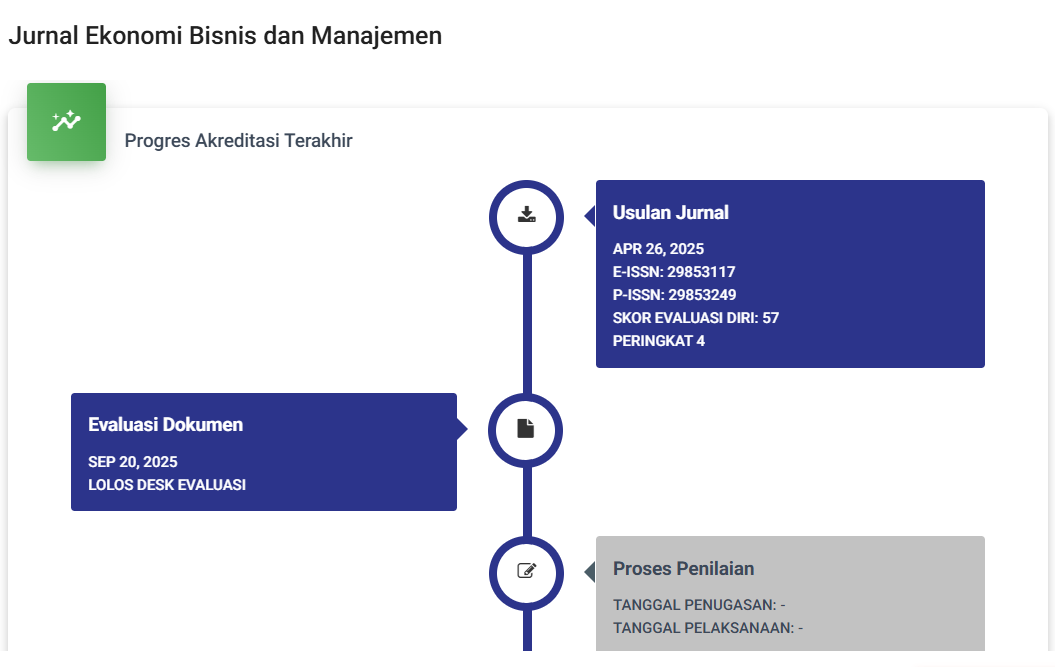

PENERAPAN METODE FIFO DAN METODE LIFO DALAM MENJAGA EFEKTIVITAS PERSEDIAAN PUPUK (STUDI KASUS PT. CAHAYA PELITA ANDHIKA) KABUPATEN TAPANULI TENGAH

DOI:

https://doi.org/10.59024/jise.v1i1.26Keywords:

Merger & Acquisitions, Profability Ratio, Leverage Ratio, Activity Ratio, Size, Financial Distress, IHSG, Merger & Acquisition Success.Abstract

Abstrak. The purpose of this research is to find out the right method to achieve optimal profit at PT. Andhika's lamp. Meanwhile, the formulation of the problem in this study is how this research method uses a descriptive quantitative approach with the ex post facto research method, namely research on data collected after the event occurred.

The research was conducted by examining purchase cards and use cards in 2021. The conclusion of this study is that within a one-year period it can be concluded that the ending inventory value generated using the FIFO method is Rp. 118,840,000, while the LIFO method produces an ending inventory value of Rp. 124,440,000, the LIFO method is the opposite of the FIFO method, which produces a high cost of use so that the resulting profit is low.

Based on the conclusions of the research results using the FIFO method, when the acquisition price increases using the LIFO method will be able to produce a high cost of production, this is the impact of the average trend in determining the cost of using fertilizer and ending inventory and reducing the effect of excessive price changes. high or low so that future costs will be more stable.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 JURNAL EKONOMI BISNIS DAN MANAJEMEN (JISE)

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.