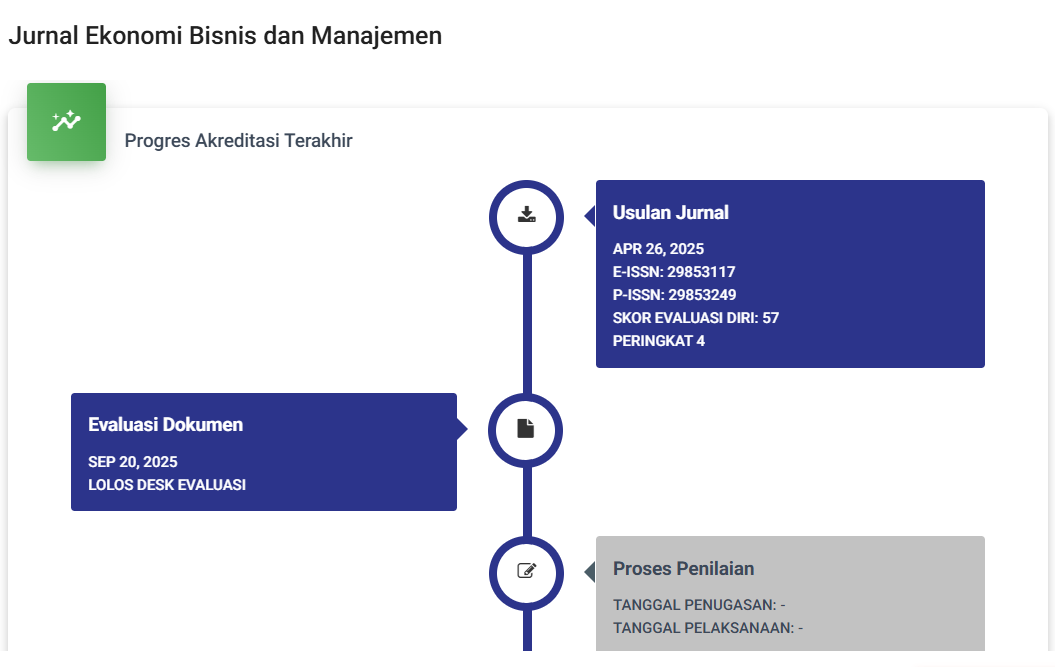

ANALISIS RATIO SOLVABILITAS DAN PROFITABILITAS UNTUK TAHUN 2018-2020 PADA PT. MARA TANTO SIREGAR KABUPATEN TAPANULI TENGAH

DOI:

https://doi.org/10.59024/jise.v1i3.401Abstract

Financial ratio analysis is one way to assess the company's financial performance. This study aims to determine the financial performance of PT. MaraTanto Siregar. The study uses financial management theory based on measuring instruments Debt to Assets Ratio, Debt to Equity ratio, Return On Investment and Return On Equity. The approach used in this research is a descriptive research approach. The samples in this study are the balance sheet and income statement of PT. Mara Tanto Siregar for 3 years for the 2018-2020 period. The data analysis technique used in this research is descriptive data analysis technique, namely collecting data, classifying it in such a way as to obtain a clear picture of the facts that exist as a reality in the object under study. The results showed that the company's financial performance as measured by the solvency ratio (Debt to Assets Ratio) and (Debt to Equity Ratio) was good, because there was an increase in the amount of debt and was followed by an increase in total assets each year and the company was able to emphasize funding using its own capital. The results of the profitability ratio analysis show that the company's ability to generate profits in terms of Return On Investment is good, the average ROI level is 31%, due to the relatively high profit on asset turnover. Meanwhile, in terms of Return On Equity, the company is also good because the company has not been able to maximize its capital to generate optimal net profit, the average during the study period was 42%.

References

Arikunto. Suharsimi, 2013. Prosedur Penelitian Suatu Pendekatan Praktek. Jakarta: PT.Rineka Cipta

Bambang, Sugeng. 2017. Manajemen Keuangan Fundamental. Yogyakarta: Deepublish

Brigham, Eugene F; Houston, Joel F. 2019. Dasar-Dasar Manajemen Keuangan Edisi 14 Buku 2. Jakarta: Salemba Empat

Hanafi. Mamduh M. 2016. Analisis Laporan Keuangan. Edisi 4. UPP STIM YKPN. Yogyakarta.

Harmono, 2014. Manajemen Keuangan: Berbasis Balanced Scorecard, Edisi Pertama, Bumi Aksara, Jakarta.

Hery. 2015. Analisis Laporan Keuangan. Yogyakarta: CAPS (Center for Academic Publishing Service).

Herry,S.E, M.Si. 2012. Analisis Laporan Keuangan. Jakarta: PT. Bumi Aksara.

Jumingan. 2013. Analisis Laporan Keuangan . Jakarta: PT. Bumi Aksara.

Kasmir. 2013. Bank dan Lembaga Keuangan Lainnya. Jakarta: PT Raja Grafindo Persada

Kasmir. 2015, Analisis Laporan Keuangan. Jakarta: Rajawali Pers

Kasmir. 2017. Analisis Laporan Keuangan. Jakarta: PT Rajagrafindo Persada.

Periansya. 2015. Analisa Laporan Keuangan. Palembang : Politeknik Negeri Sriwijaya.

Rudianto. 2013. Akuntansi Manajemen Informasi untuk Pengambilan Keputusan Strategis. Jakarta: Erlangga

Hani, Syafrida. 2014. Teknik Analisa Laporan Keuangan. Medan :In Media.

Shelly. 2015. Determinan Struktur Modal Dan Pengaruhnya Terhadap Nilai Perusahaan Wholesale Dan Retail Terdaftar Pada Bursa Efek Indonesia 2008-2012. Tesis. Universitas Esa Unggul, Jakarta.

STIE Al-Washliyah Sibolga/Tapanuli Tengah 2022, Pedoman Penulisan Laporan Penelitian Penyusunan Skripsi ”, Sibolga

Sudana, I Made. 2012. Manajemen Keuangan Perusahaan Teori dan Praktik. Jakarta: Erlangga.

Sugiyono, 2012. Metode Penelitian Bisnis. Edisi Keduabelas, Alfabeta :Bandung

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Rizky Sitompul, Safriadi Pohan, Yacub Hutabarat

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.