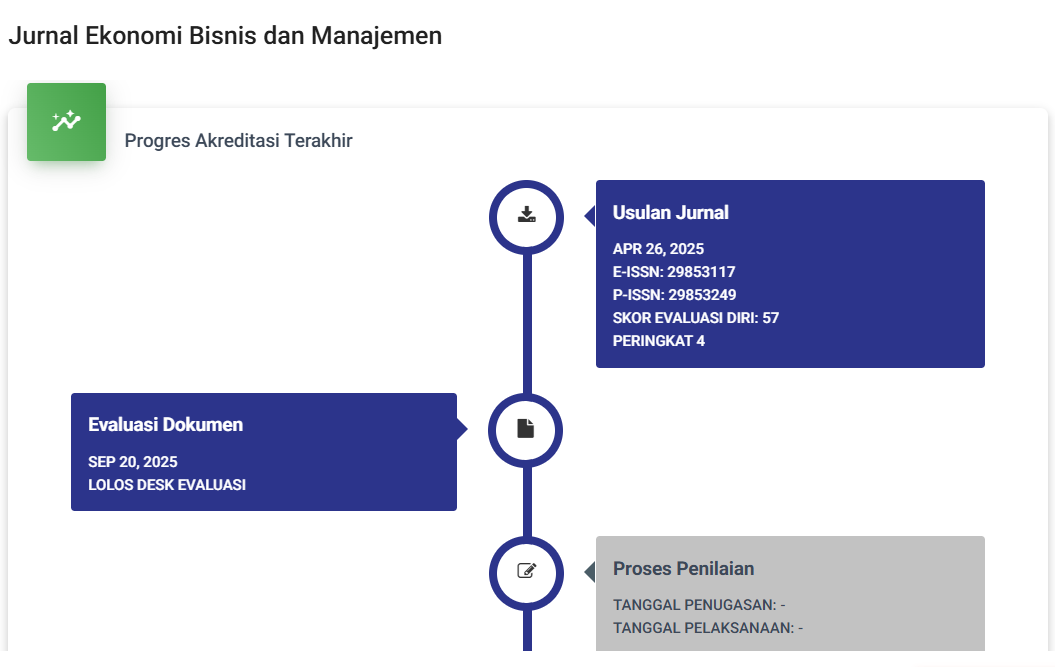

ANALISIS PENGENDALIAN PIUTANG TERHADAP RISIKO PIUTANG TAK TERTAGIH PADA PT.TRI SAPTA JAYA SIBOLGA

DOI:

https://doi.org/10.59024/jise.v1i2.113Abstract

Trade receivables represent bills arising from the sale of merchandise or services on credit. Trade receivables are usually given by sales to buyers on the basis of trust, without being accompanied by a written agreement, except for certain customers such as sub-distributors. The impact of uncollectible accounts is that it causes a risk of decreasing company profitability, which in turn can cause losses for the company. Uncollectible receivables are debts owed by other parties for a business transaction. The type of research used in this study is a qualitative descriptive research method, using secondary data collected through the process of observation, interviews and documentation at PT. Tri Sapta Jaya Sibolga. The following data analysis techniques used are data reduction, data presentation, drawing conclusions and triangulation. In the results of interviews with PT. Tri Sapta Jaya Sibolga concluded that the amount of uncollectible accounts based on the age of the receivables obtained the value of uncollectible receivables as being 1-30 days old, which means current, 31-60 days meaning substandard, 91-180 days meaning doubtful, and 181-365 days means uncollectible, where in 2017 the condition of uncollectible receivables was 9,605,854,106, in 2018 it was 12,002,571,945, in 2019 it was 17,345,325,639, in 2020 it was 8,349,776,069 and in 2021 it was 8,638,971,561.56 The results of the study show that the cause of receivables is the weak credit administration and control system that occurs because creditors do not implement the system based on predetermined procedures.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Yazid Salam Sinaga, Sahat Simatupang, Heriyawan Hutagalung

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.