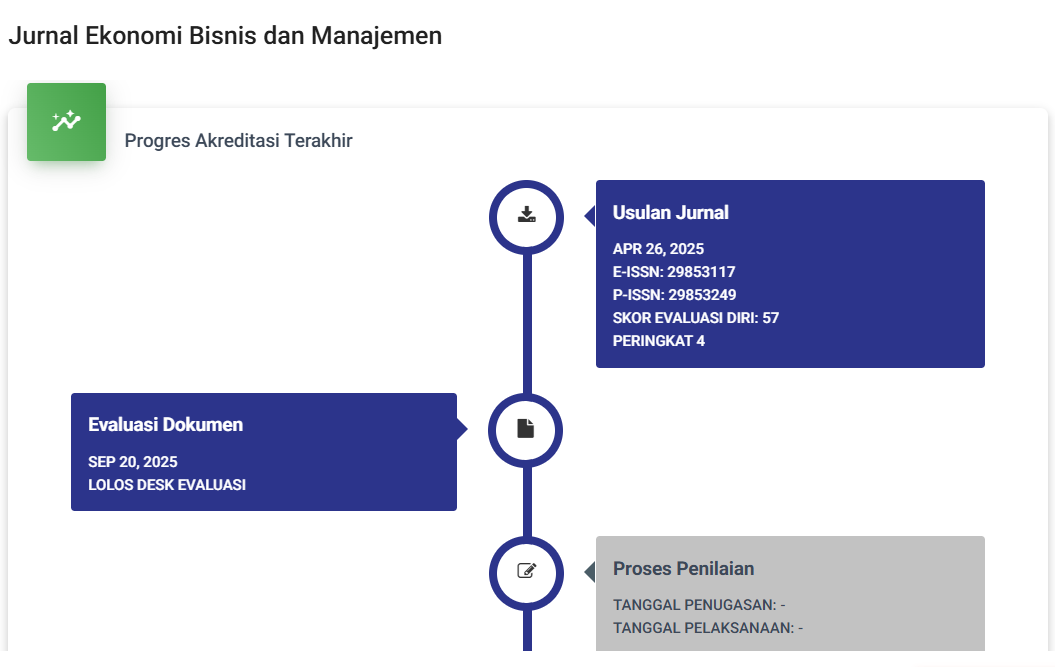

PENGARUH CORPORATE SOCIAL RESPONSIBILITY DAN CAPITAL INTENSITY TERHADAP PENGHINDARAN PAJAK (Studi Empiris pada perusahaan sektor pertambangan yang terdaftar di Bursa Efek Indonesia tahun 2019 – 2020)

DOI:

https://doi.org/10.59024/jise.v1i4.435Abstract

This study aims to examine the effect of corporate social responsibility and capital intensity on tax evasion by using research samples of mining sector companies listed on the Indonesia Stock Exchange in 2019 - 2020. The taxes levied by the state function as the main source aiming to finance public expenditures and function as a tool to regulate and implement policies in the social and economic fields and to be used for the greatest prosperity of the people and the people. The phenomenon of tax avoidance in Indonesia can also be seen from the tax ratio (Tax Ratio). Tax collection performance can be seen from the ratio of taxes collected by the state. Tax avoidance is a saving on the amount of tax payable, individual and corporate taxpayers use the weak points of existing tax rules, in carrying out their tax management. Tax avoidance is also associated with tax planning, both of them use legal means to reduce or even eliminate tax obligations, but from a tax policy point of view, neglecting tax avoidance practices can result in injustice and reduced efficiency of a tax system. . The results obtained from this study are that corporate social responsibility has a negative effect on tax evasion. Meanwhile, capital intensity has no effect on tax evasion. This study uses a quantitative approach. This test is done with linear regression

References

Agustina, S. Z. dan I. A. (2020). Pengaruh Corporate Social Responsibility dan Capital Intensity terhadap Penghindaran Pajak (Studi Empiris Pada Perusahaan Yang Terdaftar Di BEI). Jurnal Akuntansi Indonesia, 16(2), 79–86.

Dwi Sandra, M. Y., & Anwar, A. S. H. (2018). Pengaruh Corporate Social Responsibility Dan Capital Intensity Terhadap Penghindaran Pajak. Jurnal Akademi Akuntansi, 1(1), 1–12. https://doi.org/10.22219/jaa.v1i1.6947

Inastri, M. A. (2017). Pengaruh Penerapan Good Corporate Governance dan Pengungkapan Corporate Social Responsibility Pada Nilai Perusahaan. E-Jurnal Akuntansi, 21(2), 1400–1429. https://doi.org/10.24843/EJA.2017.v21.i02.p20

Isnaen, F. (2018). Pengaruh Return on Assets, Corporate Social Responsibility, Dan Capital Intensity Terhadap Tax Avoidance ( Studi Empiris Di Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2014-2016 ). Al-Mal: Jurnal Akuntansi Dan …, 02(02), 1–16. https://repository.mercubuana.ac.id/45706/

Jusman, J., & Nosita, F. (2020). Pengaruh Corporate Governance, Capital Intensity dan Profitabilitas Terhadap Tax Avoidance pada Sektor Pertambangan. Jurnal Ilmiah Universitas Batanghari Jambi, 20(2), 697. https://doi.org/10.33087/jiubj.v20i2.997

Kalbuana, N., Widagdo, R. A., & Yanti, D. R. (2020). Pengaruh Capital Intensity, Ukuran Perusahaan, Dan Leverage Terhadap Tax Avoidance Pada Perusahaan Yang Terdaftar Di Jakarta Islamic Index. Jurnal Riset Akuntansi Politala, 3(2), 46–59. https://doi.org/10.34128/jra.v3i2.56

MAR ATUN SHOLEHA, Y. (2019). Pengaruh Capital Intensity, Profitabilitas, Dan Sales Growth Terhadap Tax Avoidance Yeni Mar. Jurnal Akuntansi AKUNESA, 7(2), 684–700.

Marlinda, D. E., Titisari, K. H., & Masitoh, E. (2020). Pengaruh Gcg, Profitabilitas, Capital Intensity, dan Ukuran Perusahaan terhadap Tax Avoidance. Ekonomis: Journal of Economics and Business, 4(1), 39. https://doi.org/10.33087/ekonomis.v4i1.86

Pattiasina, V., Tammubua, M. H., Numberi, A., Patiran, A., & Temalagi, S. (2019). Capital Intensity and tax avoidance. International Journal of Social Sciences and Humanities, 3(1), 58–71. https://doi.org/10.29332/ijssh.v3n1.250

Permata Sari, L. L., & Adiwibowo, A. (2017). Pengaruh Corporate Social Responsibility Terhadap Penghindaran Pajak Perusahaan. Diponegoro Journal of Accounting, 6(4), 111–123.

Prastuti, N. K. K., & Budiasih, I. G. A. N. (2015). Pengaruh Good Corporate Governance pada Nilai Perusahaan dengan Moderasi Corporate Social Responsibility. E-Jurnal Akuntansi, 13(1), 114–129. https://ojs.unud.ac.id/index.php/Akuntansi/article/download/11647/10712

Purnamawati, I. G. A., Yuniarta, G. A., & Astria, P. R. (2017). Good Corporate Governance Dan Pengaruhnya Terhadap Nilai Perusahaan Melalui Corporate Social Responsibility Disclosure. Jurnal Keuangan Dan Perbankan, 21(2), 276–286. https://doi.org/10.26905/jkdp.v21i2.505

Reza, M. K., Yuliniar, & Simarmata, P. (2020). Prosiding biema. Business Management, Economic, and Accounting National Seminar, 1(1), 1059–1076.

Risqilah, E. W. (2020). Analisis Pengaruh Corporate Social Responsibility , Audit Committee Dan Capital Intensity Terhadap Tax Avoidance. 12(02), 127–130.

Safitri, K. A., & Muid, D. (2020). Pengaruh Pengungkapan Corporate Social Responsibility, Profitabilitas, Leverage, Capital Intensity dan Ukuran Perusahaan terhadap Tax Avoidance( Studi Empiris Pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Periode 2016-2018 ). Diponegoro Journal of Accounting, 9(4), 1–11. http://ejournal-s1.undip.ac.id/index.php/accounting

Soedaryono, B., & Riduifana, D. (2017). Pengaruh Good Corporate Governance Terhadap Nilai Perusahaan Melalui Corporate Social Responsibility. Media Riset Akuntansi, Auditing Dan Informasi, 13(1), 1. https://doi.org/10.25105/mraai.v13i1.1735

Sugiyanto, S., & Fitria, J. R. (2019). The Effect Karakter Eksekutif, Intensitas Modal, Dan Good Corporate Governance Terhadap Penghindaran Pajak (Studi Empirispada Perusahaan Manufaktur Sektor …. Prosiding Seminar Nasional Humanis, 447–461. http://www.openjournal.unpam.ac.id/index.php/Proceedings/article/view/5572

Tiara Dewi, Muhammad Amir Masruhim, R. S. (2016). PENGARUH CORPORATE SOCIAL RESPONSIBILITY DAN CAPITAL INTENSITY TERHADAP PENGHINDARAN PAJAK. Laboratorium Penelitian Dan Pengembangan FARMAKA TROPIS Fakultas Farmasi Universitas Mualawarman, Samarinda, Kalimantan Timur, 7(April), 5–24.

Wahid, S., Suwandi, M., & Suhartono. (2020). Pengaruh Leverage dan Capital Intensity Terhadap Tax Avoidance Dengan Ukuran Perusahaan Sebagai Variabel Moderasi. Jurnal Akuntansi, 1, 29–47.

Watson, L. (2012). Corporate Social Responsibility and Tax Aggressiveness: An Examination of Unrecognized Tax Benefits. SSRN Electronic Journal, 18, 529–556. https://doi.org/10.2139/ssrn.1760073

Wiguna, I. P. P., & Jati, I. K. (2017). Pengaruh Corporate Social Responsibility, Preferensi Risiko Eksekutif, Dan Capital Intensity Pada Penghindaran Pajak. E-Jurnal Akuntansi, 21(1), 418–446.

Yuliyanti, L. (2019). Pengaruh Good Corporate Governance Dan Pengungkapan Corporate Social Responsibility Terhadap Nilai Perusahaan. Jurnal Pendidikan Akuntansi & Keuangan, 2(2), 21. https://doi.org/10.17509/jpak.v2i2.15464

Zoebar, M. K. Y., & Miftah, D. (2020). Pengaruh Corporate Social Responsibility, Capital Intensity Dan Kualitas Audit Terhadap Penghindaran Pajak. Jurnal Magister Akuntansi Trisakti, 7(1), 25. https://doi.org/10.25105/jmat.v7i1.6315

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Muchammad Dava Rachmawan, Umaimah

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.