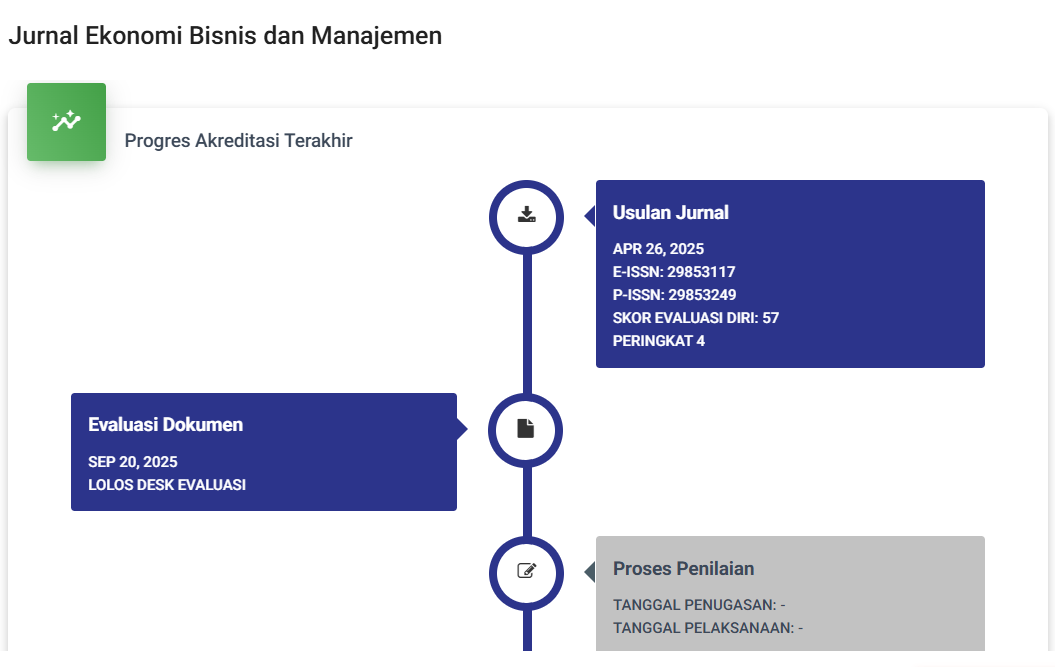

Pengaruh Profitabilitas, Ukuran Perusahaan, Tingkat Utang dan Kualitas Audit Terhadap Agresivitas Pajak

DOI:

https://doi.org/10.59024/jise.v1i4.407Abstract

This study aims to examine the effect of profitability, firm size, debt levels and audit quality on tax aggressiveness. This study used a purposive sampling method to collect secondary data samples from the annual reports of 18 food and beverage sub-sector companies listed on the Indonesia Stock Exchange (IDX) with a research period of 2020-2022. The analytical method used is multiple linear regression using the SPSS version 25 program. Tax aggressiveness is measured using the Effective Tax Rate (ETR), profitability is measured using Return On Assets (ROA), company size is measured by firm size, debt levels are measured using Debt Assets Ratio (DAR) and audit quality are measured using a dummy variable. The results of this study indicate that profitability and debt levels have a positive effect on tax aggressiveness, while firm size and audit quality have no effect on tax aggressiveness. The implications of this study ensure that the profits obtained by the company are not the result of tax aggressiveness.

References

Agustina, T. N., & Aris, M. A. (2017). Tax Avoidance : Faktor-Faktor yang Mempengaruhinya (Studi Empiris Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia Periode 2012-2015). Seminar Nasional Dan The 4th Call for Syariah Paper, 295–307. http://hdl.handle.net/11617/9246

Alkausar, B., Nugroho, Y., Qomariyah, A., & Prasetyo, A. (2023). Corporate tax aggressiveness : evidence unresolved agency problem captured by theory agency type 3 Corporate tax aggressiveness : evidence unresolved agency problem captured by theory. Cogent Business & Management, 10(2). https://doi.org/10.1080/23311975.2023.2218685

Alvin, & Susanto, Y. K. (2022). Pengaruh Leverage, Kualitas Audit Dan Lain-lainnya Terhadap Agresivitas Pajak. E-JURNAL AKUNTANSI TSM, 2(3), 255–266.

Atrianingsih, S., & Nyale, M. H. Y. (2022). Pengaruh Debt To Equity Ratio (DER) dan Return on Asset (ROA) terhadap Nilai Perusahaan dengan Sales Growth Sebagai Variabel Moderasi. JIIP - Jurnal Ilmiah Ilmu Pendidikan, 5(7), 2700–2709. https://doi.org/10.54371/jiip.v5i7.746

Dewayani, P., & Febyansyah, A. (2022). Pengaruh Profitabilitas, Struktur Modal, dan Pertumbuhan Perusahaan Terhadap Nilai Perusahaan. Journal Advancement Center for Finance and Accounting, 02(03), 394–412. http://journal.jacfaa.id/index.php

Dewi, A. C., & Pernamasari, R. (2022). The Effect of Return on Assets and Debt to Equity Ratio on Tax Aggressivity: Total Asset as Moderating Variable. Jurnal Riset Akuntansi Terpadu, 15(2), 254. https://doi.org/10.35448/jrat.v15i2.17573

Dianawati, & Agustina, L. (2020). The Effect of Profitability , Liquidity , and Leverage on Tax Agresiveness with Corporate Governance as Moderating Variable. 9(3), 166–172. https://doi.org/10.15294/aaj.v9i3.41626

Dihni, V. A. (2022). Ini Tren Tax Ratio Indonesia dalam 5 Tahun Terakhir. Katadata, 2022. https://databoks.katadata.co.id/datapublish/2022/08/05/ini-tren-tax-ratio-indonesia-dalam-5-tahun-terakhir

Fauziyah, E. R., Rizal, N., & Setyobakti, M. H. (2019). Pengaruh Corporate Governance Terhadap Tax Avoidance Pada Perusahaan Manufaktur Yang Terdaftar di BEI Tahun 2015-2017. Progress Conference, 2(July), 33–41.

Fitri, R. A., & Munandar, A. (2018). The Effect of Corporate Social Responsibility, Profitability, and Leverage toward Tax Aggressiveness with Size of Company as Moderating Variable. Binus Business Review, 9(1), 63. https://doi.org/10.21512/bbr.v9i1.3672

Hakeem, M. M. (2019). Innovative solutions to tap “Micro, Small and Medium Enterprises” (MSME) market. Islamic Economic Studies, 27(1), 38–52. https://doi.org/10.1108/ies-05-2019-0002

Hasyim, A. A. Al, Nur Isna Inayati, Ani Kusbandiyah, & Tiara Pandansari. (2022). Pengaruh Transfer Pricing, Kepemilikan Asing, Dan Intensitas Modal Terhadap Penghindaran Pajak. 23(02), 1–12.

Kanagaretnam, K., Lee, J., Lim, C. Y., & Lobo, G. J. (2016). Relation between auditor quality and tax aggressiveness: Implications of cross-country institutional differences. Auditing, 35(4), 105–135. https://doi.org/10.2308/ajpt-51417

Kartikaningdyah, E. (2019). The Effect of Firm Size, ROA and Executive Character on Tax Avoidance. 377(Icaess), 117–124. https://doi.org/10.2991/icaess-19.2019.23

Kenza, M., Zoebar, Y., & Miftah, D. (2020). Pengaruh Corporate Social Respinsibility , Capital Intensity dan Kualitas Audit Terhadap Penghindaran Pajak. 7(1), 25–40.

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270. https://doi.org/10.1016/j.intaccaudtax.2019.100270

Kuriah, H. L., & Asyik, N. F. (2016). Pengaruh Karakteristik Perusahaan Dan Corporate Social Responsibility Terhadap Agresivitas Pajak. Jurnal Ilmu Dan Riset Akuntansi, 5(3), 1–19.

Kurniati, E. R., & Apriani, E. (2021). Pengaruh Profitabilitas Dan Good Corporate Governance Terhadap Penghindaran Pajak. Medikonis, 12(1), 55–68. https://doi.org/10.52659/medikonis.v12i1.30

Kusuma, C. A., & Firmansyah, A. (2018). Manajemen Laba, Corporate Governance, Kualitas Auditor Eksternal Dan Agresivitas Pajak. TEKUN: Jurnal Telaah Akuntansi Dan Bisnis, 9(1), 108–123. https://doi.org/10.22441/tekun.v8i1.2601

Maharani, I. G. A. C., & Suardana, K. A. (2014). Pengaruh Corporate Governance, Profitabilitas Dan Karakteristik Eksekutif Pada Tax Avoidance Perusahaan Manufaktur. 2, 525–539.

Marfiana, A., & Andriyanto, T. (2021). Pengaruh Struktur Kepemilikan Perusahaan Terhadap Tax Avoidance Di Indonesia Dengan Corporate Governance Sebagai Variabel Moderasi. Jurnal Pajak Dan Keuangan Negara (PKN), 3(1), 178–196. https://doi.org/10.31092/jpkn.v3i1.1226

Marlina, E., Ismaya Hasanudin, A., & Mulyasari, W. (2022). Tax Aggressiveness: The Role of Capital Intensity and Inventory Intensity with Leverage as Intervening. Journal of Applied Business, Taxation and Economics Research, 1(6), 614–632. https://doi.org/10.54408/jabter.v1i6.97

Maulana, I. A. (2020). Faktor-Faktor Yang Mepengaruhi Agresivitas Pajak Pada Perusahaan Properti Dan Real Estate. KRISNA: Kumpulan Riset Akuntansi, 12(1), 13–20. https://doi.org/10.22225/kr.12.1.1873.13-20

Minnick, K., & Noga, T. (2010). Do corporate governance characteristics influence tax management? Journal of Corporate Finance, 16(5), 703–718. https://doi.org/10.1016/j.jcorpfin.2010.08.005

Mira, M., & Purnamasari, A. W. (2020). Engaruh Kualitas Audit Terhadap Tax Avoidance Pada Perusahaan Sektor Perbankan Yang Terdaftar Di Bei Periode 2016-2018. Amnesty: Jurnal Riset Perpajakan, 3(2), 211–226. https://doi.org/10.26618/jrp.v3i2.4415

Mulya, A. A., & Anggraeni, D. (2022). Ukuran perusahaan , Capital Intensity , Pendanaan aset dan profitabilitas sebagai determinan faktor agresivitas pajak. 6, 4263–4271.

Mulyawati, A., & Munandar, A. (2022). Audits Quality in Mediating Profitability, Liquidity, Audit Lag, Prior Opinion on Accepting Going Concern Audits. Interdisciplinary Social Studies, 1(8), 1000–1012. https://doi.org/10.55324/iss.v1i8.178

Nastiti, P. R., Karim, A., & Prabasari, B. (2022). Liquidity, Return On Assets, Leverage Against Tax Aggressiveness. 7(2).

Nurhidayah, L. P., Wibawaningsih, E. J., & Fahria, R. (2021). Pengaruh Leverage, Kepemilikan Institusional Dan Kualitas Audit Terhadap Tax Avoidance. Business Management, Economic, and Accounting National Seminar, 2(1), 627–642.

Nyale, M. H. Y. (2020). Pengaruh Leverage , Cashflow Dan Working Moderating Pada Perusahaan Jasa Transportasi 2013 - 2016. Forum Ilmiah, 17(1), 1–20.

OECD. (2022). Revenue Statistics in Asia and the Pacific: Philippines. https://www.oecd-ilibrary.org/taxation/data/revenue-statistics-in-asia/philippines_79feb264-en

Oktarini, H., Mulatsih, E. S., Kurniati, E., & Wandestarido. (2022). Pengaruh Profitabilitas, Intensitas Aset Tetap, dan Ukuran Perusahaan Terhadap Agresivitas Pajak Pada Perusahaan Industri Barang Konsumsi Sub Sektor Makanan dan Minuman Yang Terdaftar Di BEI Periode 2018-2021. JEMBATAN (Jurnal Ekonomi, Manajemen, Bisnis, Auditing, Dan Akuntansi), 7(2), 47–58.

Pattiasina, V., Tammubua, M. H., Numberi, A., Patiran, A., & Temalagi, S. (2019). Capital Intensity and tax avoidance. International Journal of Social Sciences and Humanities, 3(1), 58–71. https://doi.org/10.29332/ijssh.v3n1.250

Pratiwi, N. P. S. D. R., Subekti, I., & Rahman, A. F. (2019). The Effect of Corporate Governance and Audit Quality on Tax Aggressiveness withFamily Ownership as TThe Moderating Variable. International Journal of Business, Economics and Law, 19(5), 31–42.

Puspita, T., Azwardi, A., & Fuadah, L. (2020). The Effect of Committees Under the Board of Commissioners, Profitability and Inventory Intensity on Tax Aggressiveness (The Empirical Study of Manufacturing Companies Listed on the Indonesia Stock Exchange 2014-2018). Accounting and Finance, 1(1(87)), 114–122. https://doi.org/10.33146/2307-9878-2020-1(87)-114-122

Rahayu, S., & Suryarini, T. (2021). The Effect of CSR Disclosure, Firm Size, Capital Intensity, and Inventory Intensity on Tax Aggressiveness. Accounting Analysis Journal, 10(3), 191–197. https://doi.org/10.15294/aaj.v10i3.51446

Rego, S. O., & Wilson, R. (2012). Equity Risk Incentives and Corporate Tax Aggressiveness. Journal of Accounting Research, 50(3), 775–810. https://doi.org/10.1111/j.1475-679X.2012.00438.x

Riskatari, N. K. R., & Jati, I. K. (2020). Pengaruh Profitabilitas , Leverage dan Ukuran Perusahaan pada Tax Avoidance Fakultas Ekonomi dan Bisnis Universitas Udayana , Indonesia Email : [email protected] Fakultas Ekonomi dan Bisnis Universitas Udayana , Indonesia The Effect of Profitabilit. E-Jurnal Akuntansi, 30(4), 886–896.

Rohmansyah, B. (2017). Determinan Kinerja Perusahaan Terhadap Agresivitas Pajak (Studi Pada Perusahaan Sektor Perbankan yang terdaftar di Bursa Efek Indonesia Periode 2010-2014). COMPETITIVE Jurnal Akuntansi Dan Keuangan, 1(1), 21. https://doi.org/10.31000/competitive.v1i1.106

Rosadani, N. S. P., & Wulandari, S. (2023). Pengaruh Profitabilitas, Capital Intensity, Ukuran Perusahaan, Dan Sales Growth Terhadap Agresivitas Pajak. Prosiding National Seminar on Accounting, Finance, and Economics (NSAFE), 07(4), 1–12. http://repository.uph.edu/48993/

Rusydi, M. K., & Martani, D. (2014). Pengaruh struktur kepemilikan terhadap aggressive tax avoidance.

Sejati, F. R., & Prasetianingrum, S. (2019). Pengaruh Agresivitas Pajak, Kinerja Laba dan Leverage Terhadap Transparansi Perusahaan. Berkala Akuntansi Dan Keuangan Indonesia, 4(1), 70. https://doi.org/10.20473/baki.v4i1.14051

Sifkhiana, C., & Febyansyah, A. (2022). PengaruhProporsi Dewan Komisaris Independen, Ukuran Perusahaan, Rasio Aktivitas danRasio Utang Terhadap Kinerja Keuangan Perusahaan. Journal Advancement Center for Finance and Accounting, 1(1), 69–101.

Sihono, A., & Febyansyah, A. (2023). Tax Avoidance dan Tax Risk : Peran Moderasi dari Corporate Governance. 7(1), 1–16. https://doi.org/10.18196/rabin.v7i1.16631

Solihah, E., & Sihono, A. (2023). Profitabilitas , Tata Kelola Perusahaan dan Penghindaran Pajak Perusahaan Otomotif di Indonesia. XI(11), 97–113.

Takasanakeng, V. J. (2022). The Effect Of Financial Distress, Profit Management And Leverage On Tax Aggressiveness. Journal Research of Social …, 02(4), 597–616. https://doi.org/10.36418/jrssem.v2i04.280

Yahya, A., Agustin, E. G., & Nurastuti, P. (2022). Firm Size, Capital Intensity dan Inventory Intensity terhadap Agresivitas Pajak. Jurnal Eksplorasi Akuntansi (JEA), 4(3), 574–588.

Zenuari, I., & Mranani, M. (2020). Pengaruh Corporate Social Responsibility , Ukuran Perusahaan , Leverage , Profitabilitas , dan Capital Intensity Terhadap Agresivitas Pajak ( Pada Perusahaan Manufaktur yang terdaftar di BEI Periode 2015-2019 ). Business and Economics Conference in Utilization of Modern Technology, 187–206.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Shinta, Agus Sihono

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.