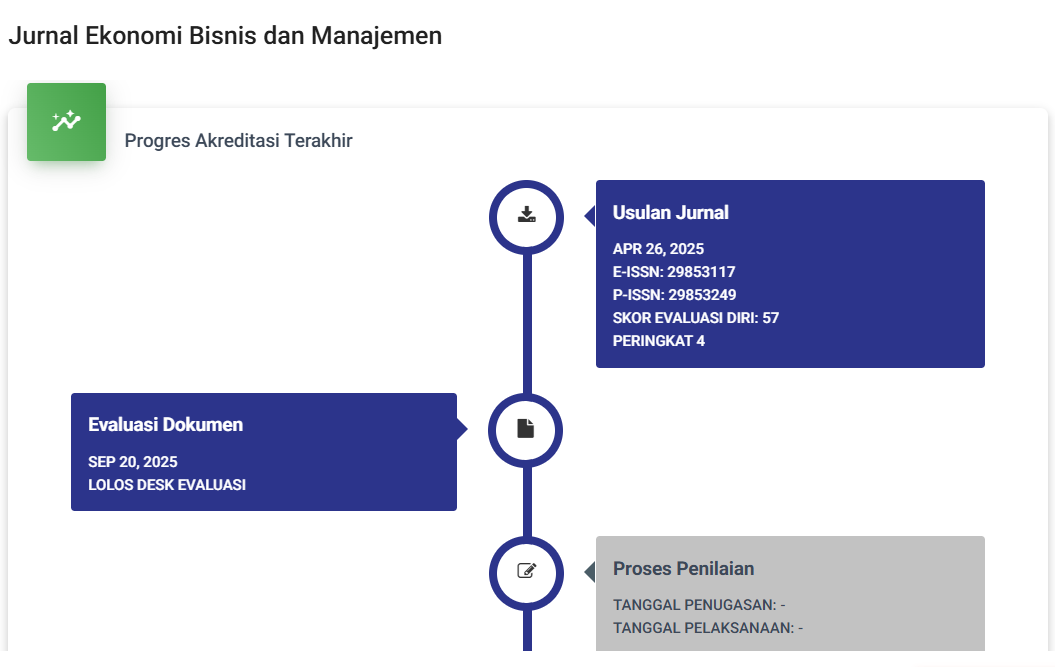

PENGARUH DANA PIHAK KETIGA DAN PENDAPATAN MARGIN TERHADAP PEMBIAYAAN MURABAHAH (STUDI PERBANKAN SYARIAH)

DOI:

https://doi.org/10.59024/jise.v1i4.321Abstract

This research is motivated by the ability of Islamic commercial banks to collect funds from the public to be channeled back to customers in the form of financing, where third party funds are one of the largest sources that can be collected by banks, so that these third party funds can affect the amount of financing to be distributed . Murabahah financing is the most popular financing in both Islamic banks in Indonesia and Islamic banks in the world, and also the effect of margin income because the higher the margin income received, the banks will indirectly increase the amount of murabahah financing because this is related to good performance. The research method used is a quantitative research method, with a sampling technique using purposive sampling with 44 research samples. The type of data used is secondary data in the form of BUS quarterly financial reports for the 2017-2019 period which are accessed and retrieved through the official website of each bank. The data analysis used is the classical assumption test, multiple linear regression analysis, t test, F test, coefficient of determination and path analysis.

References

Masykuroh, Ely. Pengungkapan Corporate Sosial Responsibility (CSR) Pada Bank Umum Syariah di IndonesiaI. Ponorogo: STAIN Ponorogo PRESS. 2012.

Muhammad. Manajemen Bank Syariah. Yogyakarta: AMP YKPN. 2005.

Loen, Boy. Manajemen Aktiva Pasiva Bank Deviden.Jakarta: Grasindo.2008.

Kasmir. Manajemen Perbankan. Jakarta: PT Raja Grafindo Persada. 2012.

Ifham, Ahmad. Ini Lho Bank Syariah! Memahami Bank Syariah Dengan Mudah. Jakarta: PT Gramedia Pustaka Utama. 2015.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Hairani winarti, Putri Zahrani Purba, Dinda Ayu Kartika, Titi Syahfitri Pane

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.