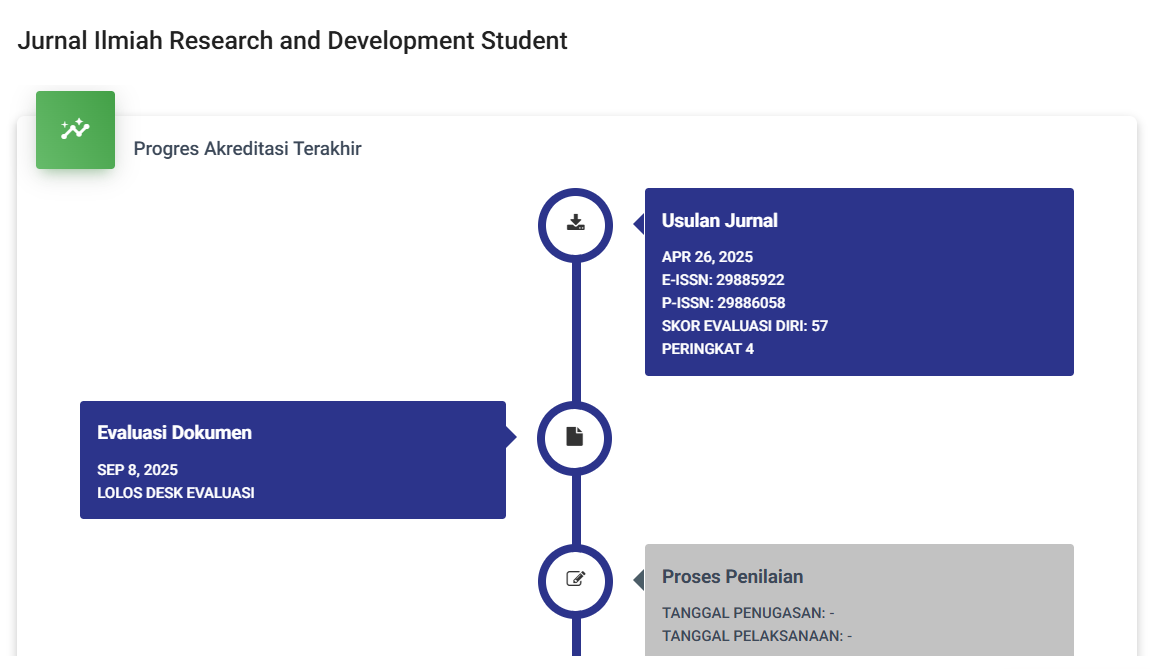

Peran Otoritas Jasa Keuangan dan Lembaga Penjamin Simpanan dalam Menjaga Stabilitas dan Keamanan Sistem Keuangan

DOI:

https://doi.org/10.59024/jis.v2i1.574Keywords:

OJK, financial system, Deposit Insurance CorporationAbstract

The Financial Services Authority (OJK) is an institution that is independent and free from interference from other parties that has the functions, duties, and authority to regulate, supervise, examine, and investigate as referred to in Law No. 21 of 2011 concerning OJK. The establishment of this banking financial services sector supervisory institution was established in accordance with the mandate of Law Number 3 of 2004 concerning amendments to Law Number 23 of 1999 concerning Bank Indonesia. This research uses the literature review method. This research combines various sources of literary information, namely books, scientific journals, newspapers, the internet, and theses related to the topic, namely "The Role of the Financial Services Authority and the Deposit Insurance Corporation in maintaining the Stability and Security of the Financial System". The financial system has a very important role in the economy. Instability of the financial system can cause economic turmoil. Restoring an unstable economic system requires very high costs and a long time to restore public confidence in the financial and banking systems. LPS has two functions, namely protecting bank customer deposits and liquidating or liquidating banks that are known to be in poor health or insolvent. LPS has successfully strengthened and restored public confidence in the financial and banking system.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 JURNAL ILMIAH RESEARCH AND DEVELOPMENT STUDENT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.