MANAJEMEN STRATEGI PERKEMBANGAN DANA PENSIUN SYARIAH DI INDONESIA

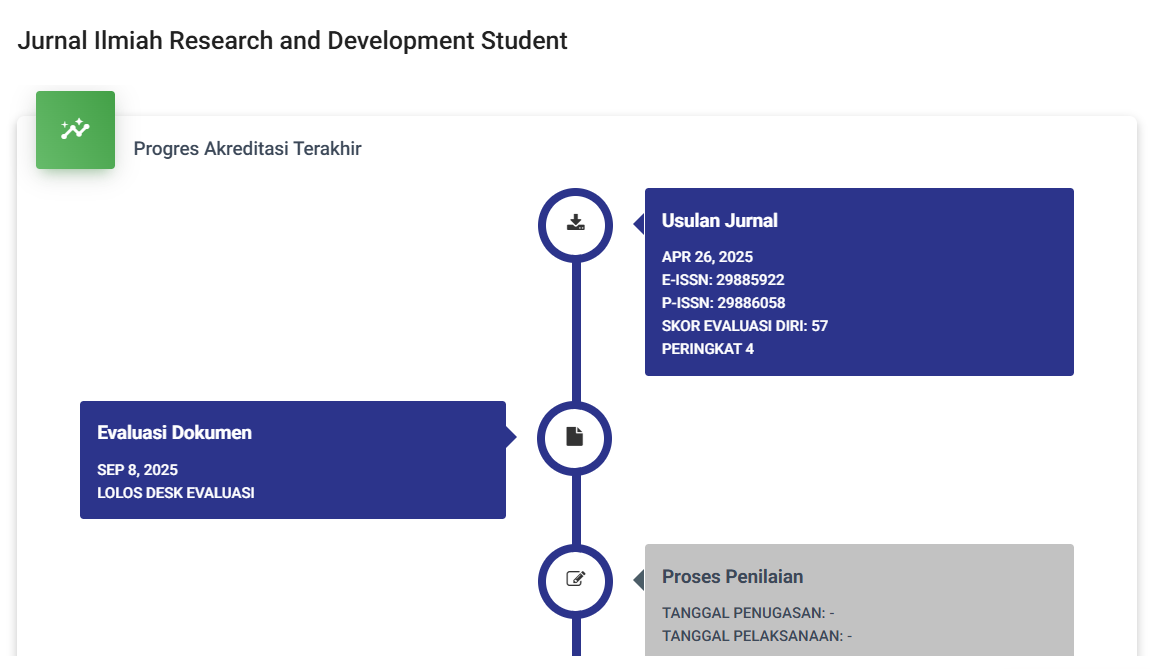

DOI:

https://doi.org/10.59024/jis.v2i1.567Keywords:

Sharia Pension Fund, Islamic financial institutions, DPLK MuamalatAbstract

Islamic pension funds are Islamic financial institutions that have characteristics to be used in order to maintain the continuity of one's income when one is no longer productively working. The purpose of this research is to find out how the role of Islamic pension funds in improving Islamic finance. This type of research is qualitative research by describing data in the form of words, schemes, images and series of sentences. The research method used is library research, which is a method of collecting data by understanding and studying theories from various literatures related to the research. Data collection uses the method of finding sources and constructing them from various sources, such as books, journals, research, law books, fiqh siyasah books, maqasid sharia books, Islamic law encyclopedias, Islamic law journals, language dictionaries and legal dictionaries, and other literature sources. The result of this research is that the increase in the number of participants in sharia pension funds occurs because Indonesian people are interested in using sharia financial products. The existence of an institution that stands in helping people like DPLK Muamalat in preparing their retirement from an early age is very easy for the people of Indonesia.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 JURNAL ILMIAH RESEARCH AND DEVELOPMENT STUDENT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.