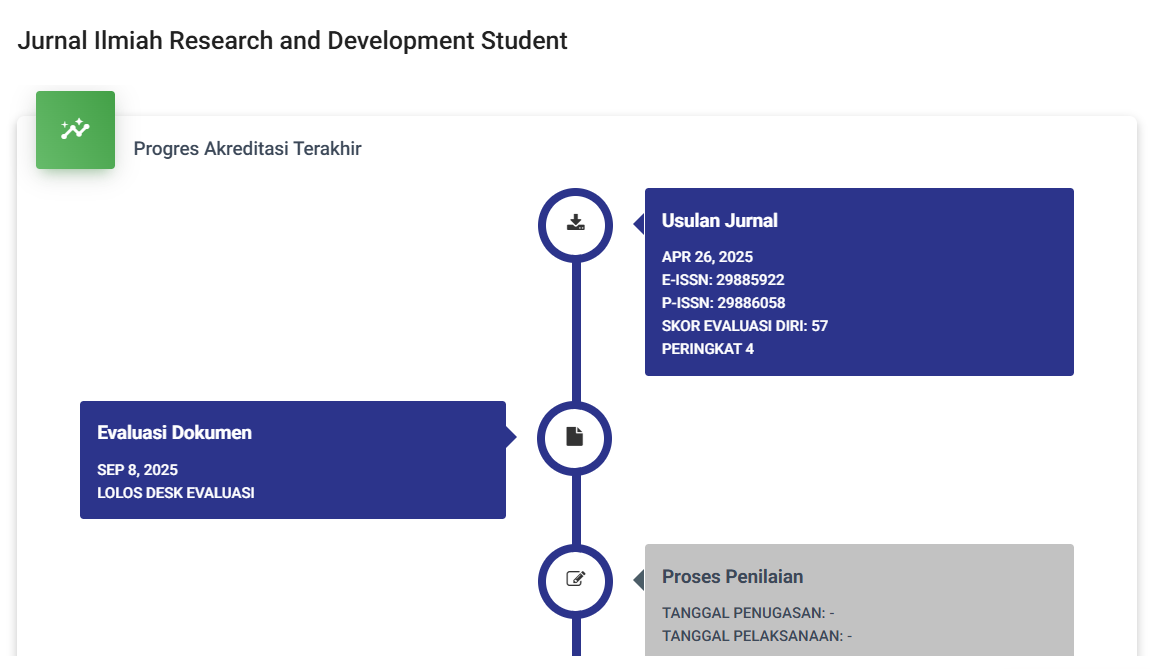

PENERAPAN MANAJEMEN RISIKO SYARIAH DALAM KOPERASI SYARIAH

DOI:

https://doi.org/10.59024/jis.v2i1.563Keywords:

cooperatives, sharia, financingAbstract

The business can develop and run smoothly with capital. Business people or businesses, whether on a small or medium scale business, can run a business that really needs capital by borrowing capital from a cooperative, one of them. A cooperative is a business or business consisting of a group, organization or association that is managed to achieve a common goal. This research uses qualitative methods, the nature of historical research methods, Data collection techniques using documentary methods can be financial reports, statistical data, books, research journals, and other relevant documents, related to the research.

In the context of partnerships and trade, modern western partnership type cooperatives are now similar to previous Islamic partnerships. And it has been practiced by Muslims until the 18th century. Both forms of Islamic syirkah and modern syirkah. Sharia cooperatives themselves were born after the mushrooming of the establishment of several Baitul Maal WatTamwiil (BMT) which was first pioneered by BMT Bina Insan Kamil in 1992. The three types of business activities are fund raising, financing and services. One type of sharia cooperative, namely the 212 Sharia Cooperative, is the National Primary Cooperative, which was founded by Muslim leaders as an implementation of the spirit of Aksi 212, which is full of brotherhood and togetherness.

Downloads

Published

Issue

Section

License

Copyright (c) 2024 JURNAL ILMIAH RESEARCH AND DEVELOPMENT STUDENT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.