Analisis Penerapan Akuntansi Zakat Dalam Laporan Keuangan Organisasi Pengelola Zakat Menurut Psak Nomor 109 Sebagai Tolak Ukur Kinerja Organisasi (Studi Kasus BAZNAS Kabupaten Banyumas)

DOI:

https://doi.org/10.59024/jis.v1i1.390Keywords:

Zakat, Zakat Acounting, PSAK 109, BAZNASAbstract

Zakat is a worship that has high social value, so that it can improve people's welfare. The higher the level of zakat acquisition, the better it is to improve people's welfare. The total acquisition of zakat in Indonesia, especially in Banyumas Regency is still not in accordance with the potential of existing zakat. BAZNAS Banyumas Regency plays an important role in increasing the acquisition of zakat according to the potential that exists in Banyumas Regency. Good zakat management is inseparable from accurate zakat accounting. The purpose of this study is to find out how the technique of applying zakat accounting and its conformity to PSAK 109 and the application of zakat accounting transparency at BAZNAS Banyumas Regency.

This study used qualitative research methods. Data collection techniques used in this study were observation, interviews and documentation. The object of this study was carried out at BAZNAS, Banyumas Regency regarding the analysis of the application of zakat accounting.

Based on the results of the study, it shows that the techniques applied in accounting for zakat at BAZNAS of Banyumas Regency are in accordance with PSAK 109. The exchange rate at BAZNAS of Banyumas Regency is prepared based on the concept of historical prices. Receipt of funds consists of zakat funds, infaq/alms, grants, APBD, and non-halal funds (banks and current account services). The application of transparency related to zakat accounting at BAZNAS in Banyumas Regency is still not optimal.

References

Amrial. (2021). Adopsi Teknologi Digital untuk Meningkatkan Realisasi Pengumpulan ZIS Nasional. Komite Nasional Ekonomi Dan Keuangan Syariah. https://knks.go.id/isuutama/32/adopsi-teknologi-digital-untuk-meningkatkan-realisasi-pengumpulan-zis-nasional#:~:text=Hasil riset Pusat Kajian Strategis,Foundation (CAF) tahun 2021 diakses pada 20 Oktober 2022, Pukul 15.32 WIB.

Atabik, A. (2015). Manajemen Pengelolaan Zakat yang Efektif di Era Kontemporer. ZISWAF : Jurnal Zakat Dan Wakaf, 2(1), 40–62.

Farouk, J. F. (2021). Pentingnya Transparansi Laporan Keuangan terhadap Kinerja Individu. Jurnal Disrupsi Bisnis, 4(5).

Fathonah. (2013). Analisis Penerapan Akuntansi Zakat Pada Organisasi Pengelola Zakat (Studi Kasus LAZISMU Kabupaten Klaten dan BAZDA Kabupaten Klaten). (Skripsi, Universitas Islam Negeri Sunan Kalijaga, 2013).

Hafnizar, A. A. (2018). Analisis Penerapan Akuntansi Zakat Pada Lembaga Amil Zakat (Studi Kasus Nurul Hayat Medan). (Skripsi, Universitas Islam Negeri Sumatera Utara, 2018).

Nurhayati, S., & Wasilah. (2012). Akuntansi Syariah di Indonesia. Salemba Empat.

Qorib, I. B. (2020). Fundraising Di NU Care LAZISNU Kabupaten Banyumas Perspektif Hukum Ekonomi Islam. (Tesis, Pascasarjana Universitas Islam Negeri Prof. K.H. Syaifuddin Zuhri Purwokerto, 2020).

Sicilia, I. (2012). Studi Penerapan Akuntansi Zakat pada Badan Amil Zakat (BAZ) Kota Pekanbaru. (Skripsi, Universitas Islam Negeri Sultan Syarif Kasim, 2021).

Sugiyono. (2017). Metode Penelitian Kuantitatif, Kualitatif, dan R & D. Alfabeta.

Syafiq, A. (2015). Zakat Ibadah Sosial untuk Meningkatkan Ketaqwaan dan Kesejahteraan Sosial. Journal.Iainkudus ZISWAF, 2(2).

UU RI No 23 Tahun 2011. (2011). Undang-Undang Republik Indonesia No. 23 Tahun 2011 Tentang Pengelolaan Zakat.

Yuliana, S. (2018). Analisis Penerapan Akuntansi Piutang pada PT. Semen Tonasa. (Skripsi, Universitas Muhammadiyah Makassar, 2018).

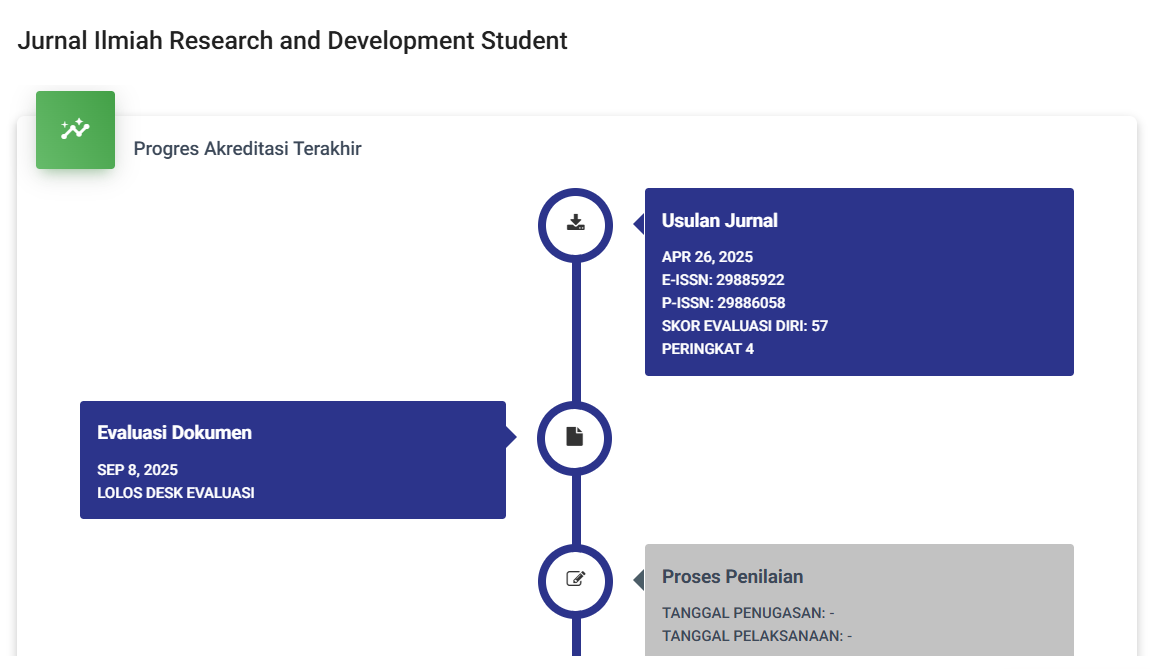

Downloads

Published

Issue

Section

License

Copyright (c) 2023 JURNAL ILMIAH RESEARCH AND DEVELOPMENT STUDENT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.