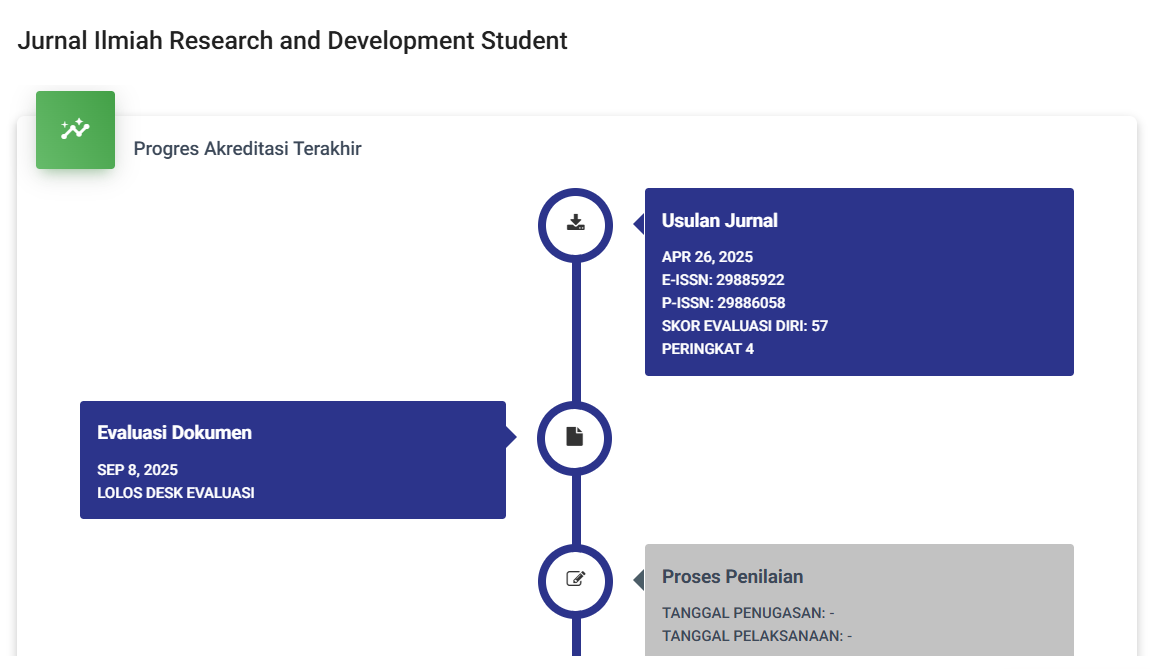

ANALISIS PERBANDINGAN KINERJA KEUANGAN SEBELUM DAN SESUDAH AKUISISI (STUDI KASUS PADA PT. FIRST MEDIA TBK)

DOI:

https://doi.org/10.59024/jis.v1i2.307Keywords:

Kinerja Keuangan; Akuisisi; Uji Beda.Abstract

This research aims to analyze whether there are differences in the company's financial performance before the acquisition and after the acquisition of PT. First Media Tbk. Financial performance is measured using a financial ratio consisting of Liquidity Ratio (Current Ratio ), Solvency Ratio ( Debt to Equity Ratio ), and Profitability Ratio (Net Profit Margin and Return on Asset ). The periods used are 2012-2014 in the period before the acquisition, and 2016-2018 in the period after the acquisition.

This research uses the documentation method in retrieving data. The population of this study is PT's financial statements. First Media Tbk. Samples used are Financial Statements in 2012-2014 and 2016-2018 using purposive sampling techniques through the website ( http://www.firstmedia.co.id). The analytical methods used are descriptive Analytical methods and different tests. The different tests used are the Paired Sample T-test and the Wilcoxon Signed Rank Test, this test uses the SPSS version 26 program application.

Results from studies using the Paired Sample T-test and Wilcoxon Signed Rank Test show that all research variables, Current Ratio (CR), Debt to Equity Ratio (DER), Net Profit Margin (NPM), and Return on Asset (ROA) there are no significant differences between before and after acquisition. The acquisition strategy has not been fully achieved because the conditions of various financial connections after the acquisition did not increase. The company's motives for acquisitions are economic motives where the acquisition decision is felt to be appropriate despite taking a brief relative research period

Downloads

Published

Issue

Section

License

Copyright (c) 2023 JURNAL ILMIAH RESEARCH AND DEVELOPMENT STUDENT

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.